作者:

Andy Kessler

From Publishers Weekly

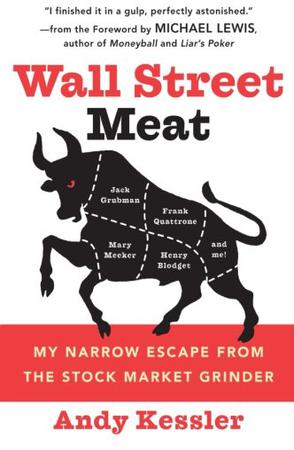

When Kessler interviewed for an analyst's position at Paine Webber in 1986, he wasn't even sure what the job entailed, but would soon learn there were "absolutely no qualifications whatsoever" for the responsibility of telling investors how to build their stock portfolios. He did happen to meet the right people, however: he palled around with Jack Grubman and then, at a subsequent job at Morgan Stanley, worked with Frank Quattrone and Mary Meeker-three analysts who later acquired varying levels of fame and notoriety during the boom-and-bust market of the late 1990s, as they were accused of deliberately recommending stocks from tech companies they knew to be overvalued. Henry Blodget was also implicated in the ensuing scandal, but despite his prominence on the cover, he has no substantial presence in this story, just a few cameos well after Kessler left Wall Street to run an investment firm in California. The subtitular implication that Wall Street "chewed up" these figures is also misleading; the men were at the top of their game when they were forced out, while Meeker has at this writing suffered nothing more than slight damage to her reputation. Kessler's denigration of her as a "clueless" rookie who became a technology "cheerleader" risks overstating the case against her as a means of pumping up the reputation of otherwise "pure analysts." False modesty and clunky dialogue do little to enhance a story that relies too heavily on Kessler's former proximity to now-famous people, while his analysis of their legal woes rarely advances beyond the superficial. Readers seeking insight into the blurring of the boundaries between investment bankers and stock analysts should wait for a book that tells that story directly, with a fuller perspective.

Copyright © Reed Business Information, a division of Reed Elsevier Inc. All rights reserved.

Michael Lewis, author of Liar's Poker, The New New Thing

A deliciously naughty new book... I finished it in a gulp, perfectly astonished." --This text refers to an out of print or unavailable edition of this title.

Rich Karlgaard, Publisher, Forbes Magazine, March 2003

This book is gripping, like watching the Zapruder film versus reading the Warren report, I couldn't put it down. --This text refers to an out of print or unavailable edition of this title.

CBS Marketwatch, Bambi Francisco

A fun read. Andy Kessler makes use of his pen, wit and cynical outlook. --This text refers to an out of print or unavailable edition of this title.

CNBC, James Cramer, Kudlow & Cramer

This book is a hoot. --This text refers to an out of print or unavailable edition of this title.

Robert Teitelman, The Daily Deal, April 4, 2003

Now arrives a fascinating little testimony from Andy Kessler...breezy, Wall Street-y style. He can be quite funny. --This text refers to an out of print or unavailable edition of this title.

Bambi Francisco, CBS MarketWatch, March 11, 2003

It's funny and brings characters to life. Andy Kessler makes use of his pen, wit and cynical outlook. --This text refers to an out of print or unavailable edition of this title.

FierceFinance April 23, 2003

"Fascinating book full of biting humor and cynicism that's informed by firsthand experiences in a crazy industry." --This text refers to an out of print or unavailable edition of this title.

Adam Lashinsky, Fortune - CNN/Money April 23, 2003

"A scathing critique of everything wrong with Wall Street ... and what's wrong with a few of the critics as well. --This text refers to an out of print or unavailable edition of this title.

Product Description

Wall Street is a funny business. All you have is your reputation. Taint it and someone else will fill your shoes. Longevity comes from maintaining that reputation.

Ask Jack Grubman, the All-Star telecom analyst from Salomon Smith Barney; uber-banker Frank Quattrone at CS First Boston; Morgan Stanley's Mary "Queen of the Net" Meeker; or Merrill Lynch's Henry Blodget.

Well, they probably won't tell you anything. But have I got some great stories for you.

Successful hedge fund manager Andy Kessler looks back on his years as an analyst on Wall Street and offers this cautionary tale of the intoxicating forces loose in the world of finance that overwhelmed sober analysis.

From the Author

Wall Street is a funny business. All you have is your reputation. Taint it and someone else will fill your shoes. Longevity comes from maintaining that reputation.

Ask Jack Grubman, the All-Star telecom analyst from Salomon Smith Barney stuck recommending the Worldcom and Global Crossing disasters. Or uber-banker Frank Quattrone, who did a few too many skanky IPOs at CS First Boston. Or Morgan Stanley’s Mary "Queen of the Net" Meeker. Or Henry Blodget, whose $400 price target on Amazon.com’s stock got him a job at Merrill Lynch.

They probably won’t tell you anything. But I will. I sat next to Jack Grubman when we both started at Paine Webber. Later at Morgan Stanley, I did deals with Frank Quattrone and was a mentor to Mary Meeker. During the heat of the Internet bubble, I befriended Henry Blodget. Have I got some great stories for you.

Add to these four folks the strategists and axes, barking dogs and Piranhas, ducks and momos, Vomit Comets and Joe Six-Stock, and you’ll get a clear picture of how Wall Street works and how analysts and bankers went from merely being famous to become notorious.

We really were just pieces of Wall Street Meat. The Street is a disgustingly lucrative capital-raising machine -- its players keep half of the revenues they generate. The tales of Jack, Frankie, Mary, Henry and all the rest of us are important, if only to show how powerful and then how fickle Wall Street can be. Creeping hubris is terminal. --This text refers to an out of print or unavailable edition of this title.

Wall Street Meattxt,chm,pdf,epub,mobi下载

Wall Street Meattxt,chm,pdf,epub,mobi下载 Debris2024-06-16 06:10:25

Debris2024-06-16 06:10:25 Jack上帝是尊贵的2024-06-28 17:35:54

Jack上帝是尊贵的2024-06-28 17:35:54 fickle薄情的2024-06-03 15:02:42

fickle薄情的2024-06-03 15:02:42 Juvenile少年°2024-06-19 09:25:14

Juvenile少年°2024-06-19 09:25:14 ╮Empress人来疯2024-06-12 19:18:29

╮Empress人来疯2024-06-12 19:18:29